The Halo Effect: Australia and New Zealand’s best angel investors 😇

In conversation with Suse Reynolds

In conversation with Suse Reynolds

Today, I’m joined by one of the truly good eggs of the Kiwi startup ecosystem. Suse Reynolds is the Executive Chair of the Angel Association of New Zealand. When I started looking to invest in Kiwi startups five years ago, Suse was one of the first to help me navigate the Kiwi ecosystem and easily the most helpful.

Suse is a founder’s best friend, a pillar of the Kiwi startup community, and beloved by operators and investors alike. She’s also a very good angel investor in her own right boasting a portfolio of 20 companies which include standouts like Flick Electricity, Ask Nicely, CoGo and more.

In this conversation, we go deep on Suse’s desire to get “New Zealandness” into the world, the history, present and future of the Kiwi angel investment landscape and the value of constructing communities of support around our most ambitious founders.

John: Tell me about yourself. How/why did you become an angel investor?

Suse: My family moved around a lot when I was little. My dad worked for the Ministry of Agriculture and we moved house every three years. It was a great way to figure out how to get along with people but through all those moves we had a farm in South Canterbury. We lived there til I was 5 and then again for a couple of years in my early teens before I went to a girls’ school in Christchurch where most of my friends also came from farms. Rural kiwis are very grounded and practical and also have such an affinity and empathy for the land and each other and what they produce.

In my late teens I went on a student exchange to Indonesia. This embedded even more deeply how super lucky I am to be a New Zealander. It also fired up a real hunger I have to get “New Zealandness” out to the world. I came home determined to work for the Ministry of Foreign Affairs. I went to Victoria University where I could keep up my Bahasa Indonesia and did law and a commerce degree majoring in international trade and international marketing. And off I went to the Ministry of Foreign Affairs and Trade. Awesome! So excited!! I had THE most brilliant time.

I worked in the Legal Division doing international trade law and then was seconded over the Foreign Minister’s office where I worked for three years; first as a private secretary and then as Press Secretary. God, I loved that job! It scared me witless at times but Sir Don McKinnon, the Foreign Minister at the time, was such a terrific boss. We travelled like crazy of course and I met some amazing people! The next gig was a posting to London where I represented NZ’s interests across agriculture, economic policy and trade. Another awesome job!

But I was starting to get a bit frustrated with how far I was from the coal face in helping to get that “New Zealandness” out to the world and the personality fit wasn’t perfect. There isn’t a lot of scope for exclamation marks in diplomacy!!

I had a bubs in London — darling Felicity who’s now nearly 21 — eeeks! When we got back to Wellington for a bunch of reasons — including having another bubs, fabulous Guy who’s 19 now — I resigned and went to work with a former MFAT colleague at the Wellington Economic Development Agency. One of my KPIs there was to bring $10m of investment to Wellington. And this, in a strange way, was the genesis of my angel investment journey… trying to find a way to stimulate investment which truly added value.

John: And so you set up AngelHQ?

Suse: Yes! Wellington needed an angel network so a friend and I set it up in 2006.

That sure had its challenging moments but I think it’ll be one of the things I am most proud of being part of… ever. I just adore the AngelHQ crew and what we have achieved — 90+ members, over $35m invested, over 85 ventures supported, 4 exits (collectively the club was in the black until just recently) and such an incredible group of wonderfully supportive, creative, generous, ambitious people.

John: Pretty impressive way to blow through your $10m economic development KPI :)

Suse: Thanks! And it started me down a whole new path.

I have this thing that we are all put on the planet to do something unique. Angel investment just seems like what I was put on the planet to do. It joins up a whole bunch of things for me and deploys a bunch of experience I’ve had right back from my days helping to negotiate free trade agreements with the Ministry of Foreign Affairs. I still believe the more we do business together, especially across borders, the less likely we are to kill each other, what’s not to love about connecting people to create fabulousness and get “New Zealandness” out to the world AND I get to work with so many incredible, brave, smart, super cool people (founders and investors) who share an aspiration to make the world a better place.

I would also love New Zealanders to be as proud of our science and deep tech as we are of the All Blacks and I see angel investment as a means of advancing that agenda!

John: Tell me about your portfolio. How much are you comfortable sharing?

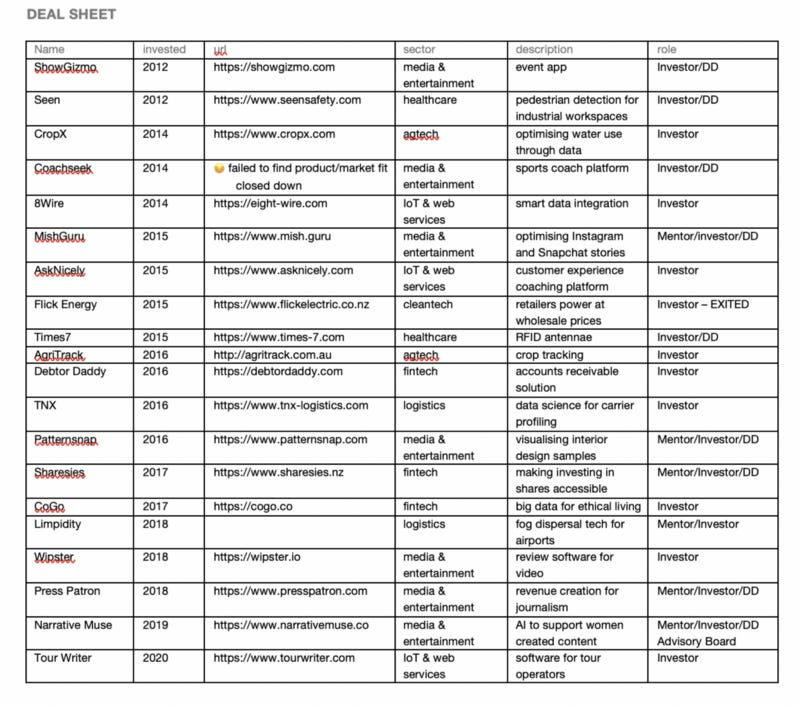

Suse: Here’s my portfolio! I’m super proud to be a nano shareholder in every single one of these ventures. They are all led by people I admire big time and I’m chuffed to be a cheerleader for them and their company. They are all leading ventures which even if things don’t end up panning out the way we both hope for, they will have still made the world a better place. I have exited out of one venture, Flick Electric and one, Coachseek, failed to fire, but not for want of trying. The founder and board handled that failure in an exemplary way. I have huge admiration for all involved.

John: Suse — you didn’t want to do this interview. Why would someone like you have imposter syndrome? Looking at your portfolio summary, it seems crazy — you’ve backed some great companies. Let’s unpack this!

Suse: It’s a funny old thing isn’t it… and it’s not just the preserve of women. I think we would have a bunch more active, engaged angel investors, who should and could be great angels, but worry about their worthiness. I had a really great talk with Dana McKenzie, a fellow angel and dear friend, earlier in the week and I think I’ve found a new peace with it. I’d be really happy to chat that through with anyone who also suffers but it’s grounded in a wee premise I’m leaning on at the moment… when you’re in perfect acceptance of all that’s happening around you and to you, you’re then able to be really creative about making the most of any given situation or dealing with it more positively and constructively. “What you resist, persists”…so I’m trying taking a kinder approach to it and working with it more gently!

John: How have you built your portfolio?

Suse: I have a pretty unique role in the angel scene in NZ. I get to see so many incredible opportunities. So there is really nothing too much more sophisticated than choosing the ones I get the biggest buzz from. Embedded in that buzz though is a stellar team and a rock star opportunity with the ability to create exponential impact and value.

John: What do you look for in an angel investment? Has that changed over time?

Suse: I’ve put my “two packets of chocolate biscuits worth” of investment into ventures with founders I’ve felt have an x-factor and are going after a highly valuable opportunity. These are founders who are super driven, have a sparkle in their eye for their venture, they are inspiring and super interesting to hang out with too.

What I mean by “two packets of chocolate biscuits worth” is that I am a small cheque writer. $5–10k in first rounds and a similar amount in those ventures that are getting traction. As a small cheque writer, there are two things I’m very conscious of… I aim to sign any documentation as soon as it lands in my inbox and to be one of the first people to deposit that cheque when the time comes.

John: Tell me about the Angel Association. Many in the audience, especially the Australians, will not be aware of the spectacular work you guys do. What is your role there as Exec Chair?

Suse: The Angel Association of New Zealand (AANZ) was established in 2008. We champion early-stage investment and aim to increase the quantity, quality and success of angel investment in New Zealand. In doing so we want to create a greater pool of capital for startups. The AANZ does a raft of fairly classic industry body stuff — we promote early-stage investment, connect industry participants through events, provide professional development and lobby the government for optimal policy settings. I was one of the founding AANZ Council members representing AngelHQ.

In 2012, at the same time Dr Ray Thomson took on the Chair role, I took on a part-time Executive Director role because I had developed a bit of a thing for the role angel investment should have in New Zealand and Ray was the perfect partner for that!! That said every Chair of the AANZ has been inspirational. Ice House’s Andy Hamilton was the first chair, Movac Venture Capital’s founder, Phil McCaw came next. Then Marcel van den Assum and most recently John O’Hara. They all share a deep belief in the contribution angel investment can make to New Zealand’s well being and future. It’s a belief that’s ‘bone marrow’ deep for me too and I’m utterly committed to advancing it.

JH: I was honoured to be in the audience in 2019 when Suse won the Kotahitanga Award (for service to the ecosystem) at the Angel Association’s Annual Summit. Pictured are: John O’Hara, Penny Fuller, Suse Reynolds, Bridget Unsworth, Debra Hall and Dana McKenzie.

When we started out there were about 300 angels across about 3 or 4 networks. We are now at nearly 1000 angels across over a dozen networks, from Invercargill to Auckland. We were investing about $20m into about 30 deals… last year we hit $128m into 130 deals.

Membership is open to organisations who have an interest in early-stage venture investment so our members include early-stage venture capital funds, tech incubators, crowdfunding platforms, law firms, wealth management firms, accounting firms, government entities and multinationals. This lines up with my belief that, much in the same way as it takes a village to raise a child, it takes a whole country to raise a startup.

The AANZ is a broad church with about 40 members including about a dozen clubs or networks. No angel network is the same as any other… they all have unique personalities! Our members meet every month (although this has been fortnightly with the advent of covid) to discuss and share deal flow.

John: Tell me about the members. Why so many angel networks?

Suse: I think our geographic profile is responsible for the fact we have so many angel networks. With just 5m people it doesn’t really stack for us to have so many networks but because we are a long and skinny country and sparsely populated and given the way angels work (we love to be close to the ventures we are backing and support local founders) then we have lots of networks.

The South Island has three smaller angel networks in the deep south so Mainland Angel Investors launched earlier this year and it combines angel networks in Invercargill, Dunedin and Queenstown. Canterbury Angels is in Christchurch and Angel Investors Marlborough and Nelson Angels at the top of the South. They are all working increasingly together. The ‘big three networks’ are all in the North Island (these have been around for the longest, have the most members etc) and they are AngelHQ in Wellington, Enterprise Angels in Tauranga and Ice Angels in Auckland. Flying Kiwi Angels has a unique M.O which sees them charge no fees for membership or raising capital for founders. It’s deeply member led. Arc Angels is Auckland based too and backs women investors and female founders. Men are welcome to be members. MIG Angels in Palmerston North, Hawkes Bay Angels in Napier and Launch Taranaki in New Plymouth are also active and engaged angel networks. Zino Ventures is awesome too — Chinese migrant investors supporting startups scaling into Asia.

John: Where to from here for the AANZ?

Suse: Marcel was instrumental in setting us up to approach angel investment in three horizons… the first decade or so has been all about the inputs (dollars, deals, angels), the next decade is all about the outputs (scaling ventures, generating exits and returns), the third decade is all about outcomes (recycling capital, supporting serial founders, the creation of a bunch of Xero’s and Rocket Labs). I just love this as a platform for driving the performance and professionalism of angel investment.

I’ve stepped into an Executive Chair role this year really committed to executing on that second horizon. That took a lot of firm talking to myself about being accountable and getting over myself too!! But I had a wee sense of the universe having its hand in the middle of my back giving me a push. I have a really clear and big vision for what early-stage venture investment can do for New Zealand… I wanted to and felt I should have a crack at championing that … I also want to start transitioning to the next thing. It’s never a good idea to spend too long in a gig. I’m so lucky to be working with Bridget Unsworth too who is transitioning to be Executive Director. She’s perfect for the role and shares a similar vision and hunger for the impact early-stage venture investment can have for New Zealand.

I want to spend the next 2–3 years seeing what I can do to help take early-stage venture investment to the next level … fundamentally this is about supporting angels to support founders to generate awesome ventures… ventures creating so much of the net new job growth we need, future-proofed resilient jobs, ventures which are the fuel for kiwi platform plays around renewable energy, agtech, future foods, aerospace, health tech and digital tech (B2B SaaS, fintech, AR/VR, AI etc) and creating the kinds of ventures which will be magnets for talent attraction and making us a world leader creating a sustainable economy generating exponential impact … a lot of buzz words in there I know but I do think this is New Zealand’s time… the kiwi USP is empathy… for people and the planet … it’s our secret sauce for exponential, sustainable value creation.

John: How has the Kiwi investment landscape changed over time?

Suse: I think we are getting better at being early-stage venture investors. I have a thing about angel investment being a bit like Montessori on steroids… you can only learn by doing. And we have been doing this for over a decade now.

One of the shifts I’m most chuffed about is our increasing alignment and sense of unified purpose with founders. This is reflected in our Runway events where we get founders and investor directors together in a room. No pitching, just learning and sharing how to do this thing well.

The other initiative which I believe is helping us to be better early-stage investors is our Flight programme for the 130 or so really active angels and investor directors of that 1000 or so members across our angel networks. We get these people together half a dozen times a year for 4 half-day workshops and two away weekends to share how we are grappling with problems and share solutions we’ve found in working with those ventures we are supporting. The next weekend away is in Blenheim and will focus on founder and investor director well being and making commitments to inject and support more diversity in our community.

John: What do you see as the strengths/weaknesses of the Kiwi approach to angel investment?

Suse: Strengths — we work well together, we syndicate like mad things (some would say because we have to!), we’re aware of the need to learn and that there are others who do this better than us and we do a lot with a little (our valuations are still pretty appealing and our ventures make great traction with less capital than ventures in other parts of the world)

Weaknesses — a former head of the Council for Trade Unions once said to me that New Zealanders are very good at believing in themselves but not so good at believing in each other! I see this so often. We could do so much better when it comes to supporting, collaborating and learning from each other. This might seem to conflict with the statement about working well together and our syndication levels. We do work well together but we could do it way way more and way way better. We largely syndicate to raise the requisite capital but we also need to collaborate more on deal origination, shaping deals together and doing DD together. Not least, if we did this well, it would make us way more appealing to founders!

We also have great fortitude but this sometimes means we hang on to and keep funding ventures we perhaps shouldn’t. I think we can put some of this down to the fact it’s difficult to make hard or tough calls when you’re so likely to bump into that person in the supermarket or airport lounge… not easy!! But making the tough calls, even if it’s tricky, is the totally right thing to do… it liberates capital, capability and time on the investor side and liberates the founder for the next startup (their own or someone else’s) with a ton of relevant and powerful experience.

We are often not ambitious or hungry enough. Startup Genome reflects this in their findings which showed our founders score really high when it comes to wanting to change the world but when it came to selecting the TAM (total addressable market) they were going after, they chose the smallest number!

Finally, and perhaps most importantly, more honesty would be great. If we are more generous, courageous and respectful with honesty we will create better ventures and angels.

John: Do you lead/follow/both? Tell me about your approach to syndication.

Suse: Both. And syndication rocks… much like a child can’t have too many people loving them, an angel backed venture can’t have too many people supporting them. The only caveat to that is that syndication partners need to be ‘good humans’ and trust and respect the lead in the deal.

John: Are you actively involved after investing? What should founders expect of you pre and post investment?

Suse: Yes. Love, love getting updates… and do my best to reply and/or chip in with any connections or intel I might have. Also, I’m there big time if and when founders are struggling, scared, exhausted — gotta talk that stuff out and know you’re not alone. It’s super important founders know we are on their wing, through good times and bad.

John: Has Covid19 changed anything about your approach?

Suse: Oh my god… it’s just made me even more crazy committed to promote this space, this asset class. The rationale for angel investment stacks more than ever from a head and heart perspective. Recession vintages are some of the best for venture investment returns and when you support high growth tech ventures, you are part of creating almost all the net new job growth in an economy and we need new jobs more acutely than ever right now!

John: How can founders best reach you? When should they approach you?

Suse: LinkedIn is probably best with a wee personal message — not just a ‘please can we connect’. And by all means, rock up to me at events. Founders are the wind beneath my wings and help me to be brave about what I’m doing. Inspire me every day!!

John: What have you seen other angels do well/badly?

Suse: What I’ve seen angels do well is understanding that they are just the investor. It’s not their company!! Angels who ask all the right questions, in the right way with insight, care and humility, even when they think they know the answers, are the bomb. Angels who are super good introducers are also just the bomb.

John: What advice would you give to founders seeking their first angel investment?

Suse: Do your DD on us… seriously!! Ask at least three people about us and ask if you can speak to people we have backed and people we have decided not to back!! Look for angels who love learning and ask great questions. Look for angels who are over themselves and genuinely want to support you to shine. When it comes to angels on your board, you don’t necessarily need angels with domain experience relevant to your venture, but make sure they have other relevant experience … have raised capital, have been a CFO, have great networks, have been a recruiter and can read people.

John: How can people who want to angel invest, but don’t know where to start, get involved? What advice would you give to a first-time angel investor?

Suse: Find someone who is doing it well and ask if you can buddy up with them. Please, be brave about doing this. I know you might feel a little vulnerable doing this but it truly is the best way. And read! There is so much great material online; fossick about on the AANZ website and check out Seraf, this is populated by great snack bites of ‘how to angel invest’ by a Boston based angel network and two guys who have been great friends to kiwi angel-dom!

Don’t rush to write your first check… take part in a couple of DD exercises. You can only learn by doing. Find an experienced angel who you know it’ll be ok to ask the ‘dumb questions’ of … but to be honest, only dumb people don’t ask questions. Please ask those questions even at investment evenings or chatting afterwards. Angels love sharing knowledge… it’s how we roll, it’s actually how we have to roll or the whole thing grinds to a halt. I often think angel investment is a bit like London traffic … you have to let people in, you have to ‘give before you get’ for the whole thing to keep moving!!

John: What do you know now that you wish you knew when you started angel investing?

Suse: I’ve been mulling and mulling on this question… I think that’s the joy of angel investing. There is always stuff you wish you’d known. But it’s almost pointless to wish that because you can only learn by getting amongst it.

There is one thing though that I’m always super conscious of telling people thinking of getting into angel investment and it’s this… while it’s incredibly inspiring and rewarding, it’s also the opposite… hugely confronting, scary and incredibly hard work at times, especially if you are going to be really active and get into governance too. There’ll need to be lots of creative thinking and telling yourself that it’s going to be ok… no matter how it all turns out!!

Know any great angel investors who deserve a shout-out? I would love to meet them. Email: john at airtree dot vc

Other stories in The Halo Effect Series include: Matt & Aprill, Rowan and Les.